Property Damage Can Be Fun For Everyone

Wiki Article

Little Known Questions About Public Adjuster.

Table of ContentsThe Ultimate Guide To Property DamageThe Main Principles Of Public Adjuster The Ultimate Guide To Property Damage

A public insurer is an independent insurance coverage specialist that a policyholder may employ to assist clear up an insurance policy case on his or her behalf. Your insurance provider provides an insurer at no cost to you, while a public insurance adjuster has no partnership with your insurance coverage firm, and bills a fee of up to 15 percent of the insurance coverage settlement for his or her solutions.

If you're thinking of working with a public insurance adjuster: of any kind of public insurance adjuster. Request suggestions from family and also affiliates - loss adjuster. See to it the insurance adjuster is licensed in the state where your loss has actually happened, and call the Better Company Bureau and/or your state insurance division to check up on his/her document.

Your state's insurance policy division might set the percentage that public adjusters are permitted fee. Be cautious of public insurance adjusters that go from door-to-door after a catastrophe. public adjuster.

Savings Contrast prices and conserve on house insurance today! When you submit a claim, your house owners insurance policy company will designate a cases adjuster to you.

6 Easy Facts About Property Damage Described

Like a claims insurance adjuster, a public insurer will examine the damage to your residential or commercial property, assistance determine the range of fixings and approximate the substitute value for those repair work. The huge distinction is that as opposed to working on part of the insurance provider like an insurance coverage declares adjuster does, a public insurance claims insurer benefits you.

The NAPIA Directory site details every public adjusting firm called for to be accredited in their state of operation (public adjuster). You can enter your city and state or ZIP code to see a list of adjusters in your location. The other means to find a public insurance policy adjuster is to get a suggestion from close friends or family participants.

Reading online client testimonials can also be practical. As soon as you locate a few competitors, locate out how much they bill. The majority of public insurers maintain a percentage of the final claim payout. It might be just 5 percent and also as high as 20 percent. If you are facing a large case with a possibly high payout, element in the cost before selecting to hire a public insurer.

Our Property Damage Ideas

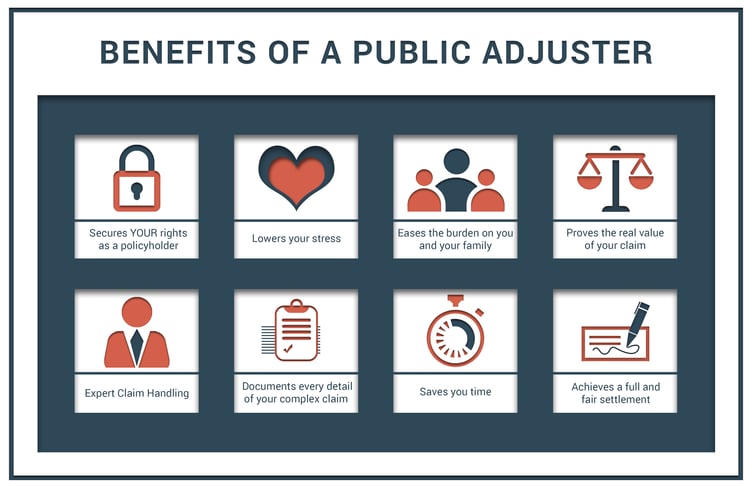

To testify to this commitment, public insurers are not compensated front. Instead, they get a percentage of the negotiation that they get in your place, as controlled by your state's division of insurance coverage. A skilled public insurer functions to complete several tasks: Understand as well as examine your insurance plan Support your rights throughout your insurance policy case Accurately and completely assess and also value the range of the home damages Apply all policy stipulations Negotiate a made the most of settlement in an effective as well as efficient way Dealing with an experienced public adjuster is one of the ideal methods to get a fast and fair negotiation on your case.

Your insurance coverage firm's reps are not always going to browse to discover all of your losses, seeing as it isn't their obligation or in their best passion. Given that your insurer has a specialist working to secure its interests, should not Learn More Here you do the very same? A public insurance adjuster can service numerous different sorts of insurance claims on your behalf: We're frequently inquired about when it makes good sense to work with a public insurance claims insurer.

The larger and also much more complicated the case, the much more most likely it is that you'll need expert assistance. Employing a public insurer can be the right choice for various kinds of residential or commercial property insurance coverage cases, specifically when the stakes are high. Public adjusters can aid with a variety of valuable tasks when navigating your insurance claim: Analyzing policy language and determining what is covered by your provider Conducting a thorough analysis of your insurance coverage Considering any kind of recent changes in building regulations as well as regulations that could supersede the language of your plan Finishing a forensic evaluation of the building damage, frequently uncovering damages that can be otherwise tough to locate Crafting a customized prepare for getting the most effective negotiation from your home visit homepage insurance policy claim Documenting and valuing the complete level of your loss Compiling photographic evidence to support your case Taking care of the everyday tasks that commonly come with submitting a case, such as interacting with the insurance provider, participating in onsite meetings as well as sending records Providing your insurance claims bundle, including sustaining paperwork, to the insurance policy business Skillfully bargaining with your insurance policy business to guarantee the largest settlement feasible The best component is, a public claims insurer can get involved at any point in the claim filing process, from the minute a loss strikes after an insurance coverage claim has actually already been paid or denied.

Report this wiki page